•The research of the TCRC allows us to imagine the volume of cargo flows moving between countries located along the Middle Corridor.

•The comprehensive study prepared by our organization is based on a 10-year trend in rail transportation along the Middle Corridor.

•The study was carried out in Georgia, Azerbaijan, Kazakhstan, and Uzbekistan, where the Middle Corridor cargo flows are generated and formed.

•Additionally, China, a country that originates cargo flows and distributes them through various corridors, was studied. The study does not include the movement of Chinese block trains.

•Russian cargo was studied to clearly see the volume of cargo flows transported through the Northern Route and define the volume of freight that the Middle Corridor has the potential to attract.

•The statistical data used in the study are based on the annual reports of the Organization for Co‑operation between Railways (OSJD).

•A study of transport flows along the Middle Corridor could be used to develop an action strategy to attract additional freight flows.

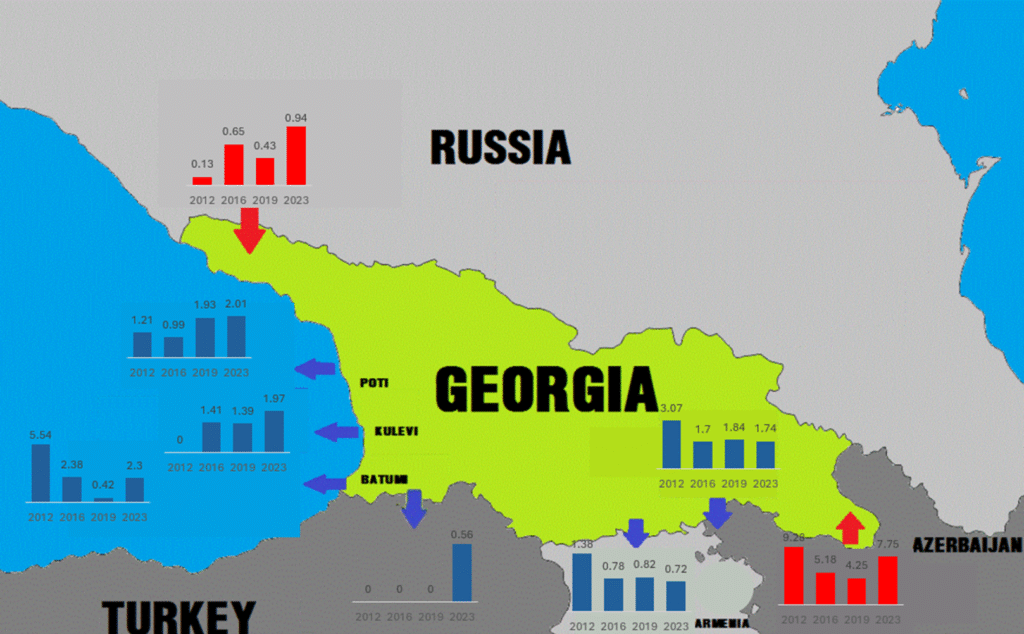

Georgia

•Over the past 10 years, cargo turnover from Georgia to Azerbaijan decreased by 40% (from 3 million tons to 1.8 million tons), while the drop from Azerbaijan to Georgia was 15% (from 9.3 million tons to 7.8 million tons). This indicates a decrease in cargo flows from Europe to Central Asia.

•In recent years, transportation from Georgia to Armenia has been stable at 0.7-0.8 million tons. Compared to 2012, the “peak” volume was 1.4 million tons, and in 2023 it decreased to 0.72 million tons. This indicates a 50% reduction in transportation from Georgia to Armenia.

•The capacity of the Baku-Tbilisi-Kars railway is 5 million tons; However, in 2023, only 0.6 million tons were transported through it, using only 11% of its capacity, which is a low figure.

•For the Port of Poti, an average of 2 million tons of cargo by rail does not represent a high level of transportation.

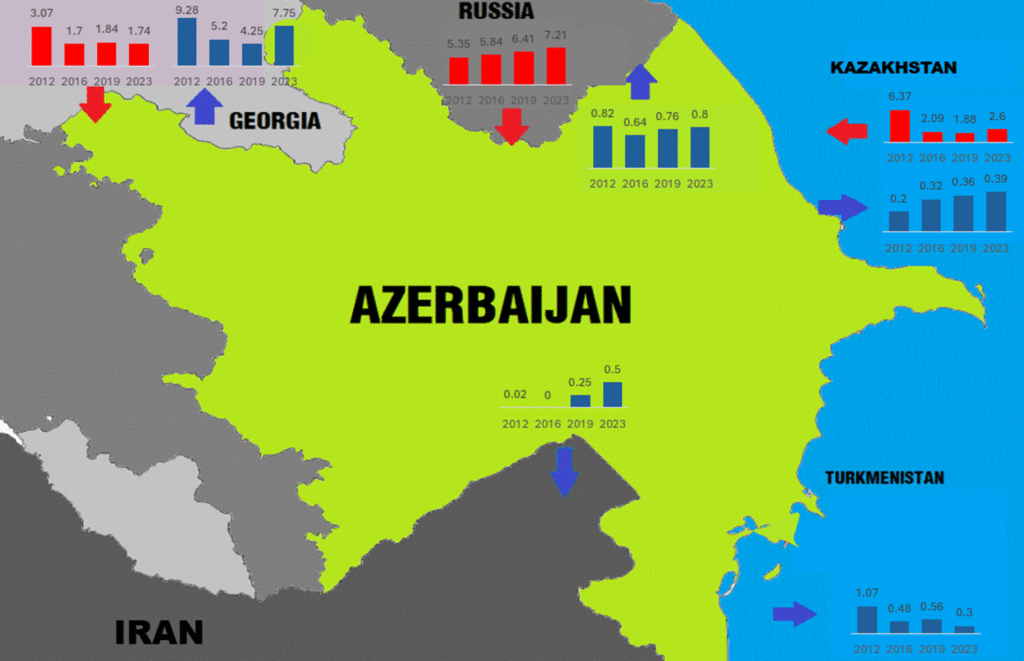

Azerbaijan

•Azerbaijan is connected by rail to Russia and Iran, and by the Caspian Sea to Kazakhstan, Turkmenistan, and the ports of Iran.

•Both north–south and east–west transport corridors pass through Azerbaijan.

•In recent years, Azerbaijan has become a major logistics hub in the Middle Corridor, thanks to significant investments in transport infrastructure.

•Rail transportation from Russia to Azerbaijan is 9 times greater than reverse transportation from Azerbaijan to Russia, due to the North-South corridor connecting Russia, Azerbaijan, and Iran, passing through Azerbaijan.

•The Azerbaijan-Kazakhstan route via the Caspian Sea is the main axis of the Middle Corridor. It is crucial to generate cargo flows through the Caspian Sea transport artery in both the Azerbaijan-Kazakhstan and the reverse direction.

•The transport flow from Azerbaijan to Kazakhstan across the Caspian Sea is low, which is 7 times less than the total transportation from Kazakhstan to Azerbaijan through the ports of Aktau and Kuryk.

•Of the 3 million tons of cargo transported from Kazakhstan to Azerbaijan, 30-40% remains in Azerbaijan, while the rest is sent to Georgia. The cargo flow of the Middle Corridor reaching Georgian ports amounts to 1.6-1.8 million tons. Which is a low figure.

•It can be concluded that one of the crucial problems of the Middle Corridor is the lack and imbalance of reverse cargo from Europe to Asia.

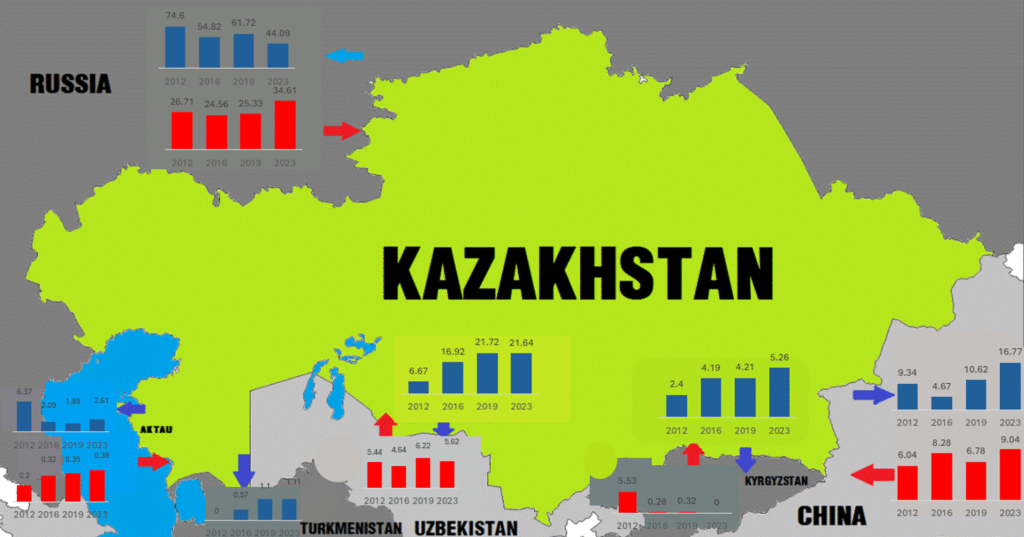

Kazakhstan

•The main cargo flows are formed with Russia, China, and Uzbekistan through transport corridors passing through Kazakhstan.

•Total cargo flows in Kazakhstan are on average 8-10 times higher than the cargo flows in the countries located along the Middle Corridor. This indicates the importance of Kazakhstan for the Middle Corridor in terms of cargo generation.

•From Kazakhstan to Russia and vice versa, in 2012, a “peak” of 100 million tons of cargo was transported by railway, and in 2023, 78 million tons. The 12% decrease indicates that some cargo was redirected to alternative routes, including the middle corridor.

•If we analyze the dynamics of cargo flows from Kazakhstan to Russia, 75 million tons were transported in 2012, which is 1.7 times higher than the transportation in 2023, when it amounted to 44 million tons.

• The imposition of sanctions caused the reduction of the cargo flows to Russia, because large Kazakh metallurgical and chemical enterprises, which are listed on various stock exchanges, bypass the corridors passing through Russia. All of this should be considered a positive trend in redirecting Kazakh cargo through the Middle Corridor.

•An analysis of cargo flows on the Kazakhstan-China border shows that in 2023, 1.9 times more cargo was imported from Kazakhstan to China – 16.8 million tons – than was exported from China to Kazakhstan – 9.0 million tons.

•The freight traffic figures between Kazakhstan and China confirm that China is not a significant country in terms of generating massive rail freight for the Middle Corridor. The exception is transportation by container block trains from/to China.

•In 2023, the cargo flow generated by Kazakhstan with only three neighboring states will total 132 million tons, including Kazakhstan – Russia – 78 million tons, Kazakhstan – China – 26 million tons, Kazakhstan – Uzbekistan – 28 million tons.

•Only a miserable 2% of the total cargo flow generated by Kazakhstan was redirected to the Caspian Sea, which indicates underusage of the infrastructure in the Middle Corridor towards the Caucasus.

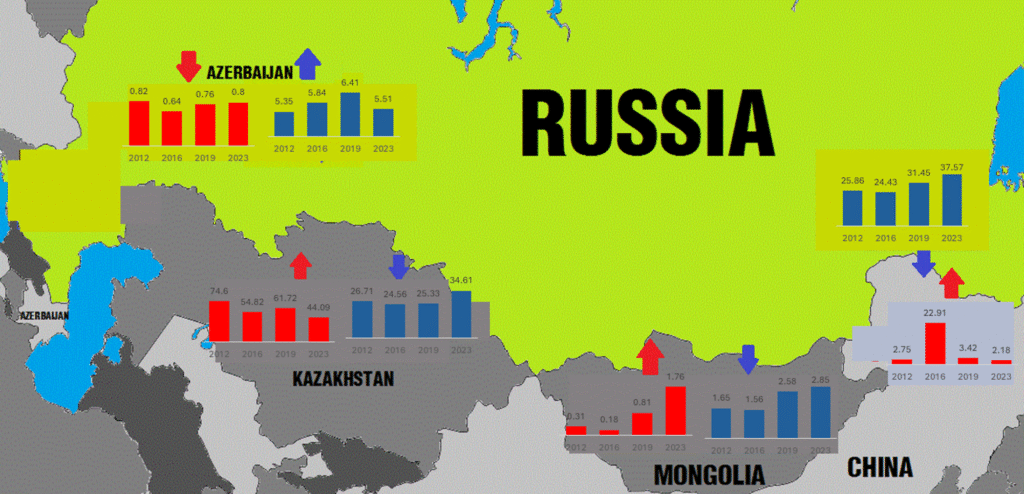

Russia

•The China-Kazakhstan-Russia corridor (Eurasian Corridor) and the Russia-Azerbaijan-Iran corridor (North-South Corridor) compete with the Middle Corridor. Both corridors pass through Russia.

•The movement of cargo between Russia and China is characterized by a significant imbalance. The volume of freight sent from Russia to China is 12-15 times greater than the volume of cargo sent from China to Russia.

•In 2023, the cargo flow from Russia to China reached a “peak” volume of 38 million tons, when only 2.0 million tons were sent from China to Russia.

•The cargo flow between Russia and Mongolia is 3-5 million tons, the main part of which is cargo exported from Russia.

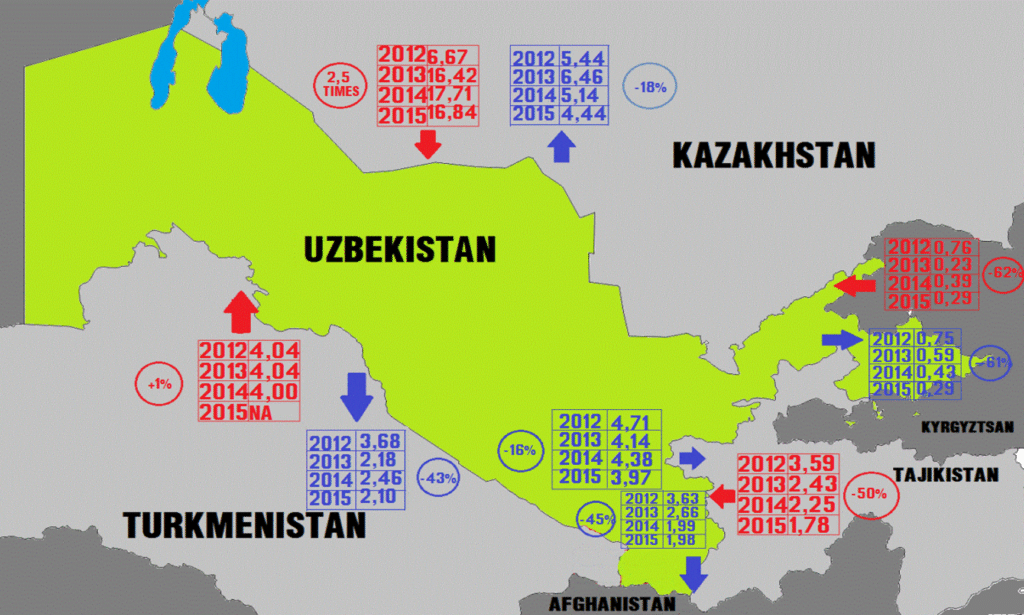

Uzbekistan

•Uzbekistan is located on the TRACECA route, a powerful branch of the Middle Corridor.

•Along with Kazakhstan, Uzbekistan has railway connections with Tajikistan, Kyrgyzstan, Turkmenistan, and Afghanistan.

•In recent years, cargo turnover between Kazakhstan and Uzbekistan has been within the range of 20-27 million tons.

•Four times more cargo is transported from Kazakhstan to Uzbekistan than from Uzbekistan to Kazakhstan. In 2023, 22 million tons of freight were transported from Kazakhstan to Uzbekistan, and 6 million tons from Uzbekistan to Kazakhstan.

•The total volume of cargo with Uzbekistan’s neighboring countries (Kazakhstan, Turkmenistan, Kyrgyzstan, Tajikistan, Afghanistan) is 40 million tons.

•Only a miserable 1.5% of the total volume reaches the Georgian transport section via the TRACECA corridor.

•Attracting such a small volume of cargo flow from Uzbekistan allows us to draw the following conclusion: That the TRACECA corridor fails to use the potential of Uzbekistan as a cargo-producing country.

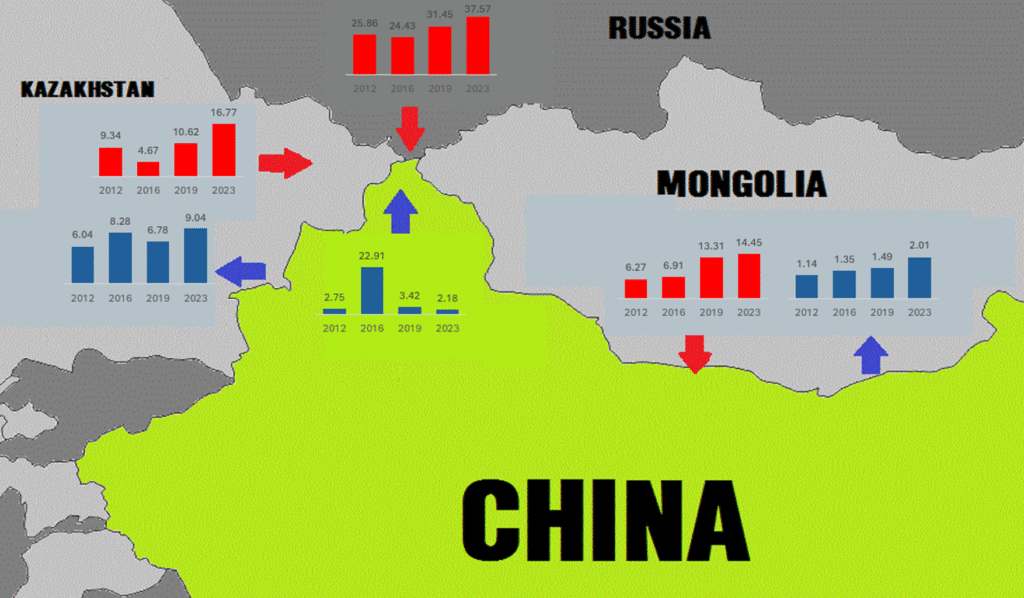

China

•China is connected by rail to Russia, Kazakhstan, and Mongolia. If we exclude container block trains, as a separate study, significantly more cargo flows into China from all three neighboring countries than flows out of China to them.

•China – Kazakhstan: In 2023, 17 million tons of cargo entered China from Kazakhstan, and 9 million tons entered Kazakhstan from China. This indicates that Kazakhstan’s cargo flow is 1.85 times higher.

•China – Russia In 2023, 38 million tons of cargo entered China from Russia, and 2 million tons from China entered Russia. This indicates that Russia’s cargo flow is 17 times higher.

•China – Mongolia In 2023, 15 million tons of cargo entered China from Mongolia, and 2 million tons entered from China. This indicates that Mongolia’s cargo flow is 7 times higher.

•An analysis of rail freight traffic between China and three neighboring countries shows that China is not a significant source of freight for bulky goods.

Research results

•The main problem of the Middle Corridor is the lack and imbalance of reverse cargo from Europe to Central Asia. The cargo flow from Central Asia to Europe is 7 times that of the reverse flow from Europe to Central Asia.

•Approximately 1.6-1.8 million tons of cargo flow from Kazakhstan’s ports passed through Azerbaijan and entered Georgian ports. This is a low figure for the Middle Corridor, and indicates the need to develop infrastructure, primarily the fleet, in the Caspian Sea and rolling stock on the Georgian Railway.

•A total of 132 million tons of cargo were generated in Kazakhstan in 2023, including Kazakhstan – Russia 78 million tons, Kazakhstan – China 26 million tons, Kazakhstan – Uzbekistan 28 million tons. Only a miserable 2% of the Middle Corridor went towards the Caspian Sea, which indicates the low rate of cargo transported from the Central Asian region via the Middle Corridor and requires the development of a unified tariff policy.

•A study of cargo flows from Kazakhstan to Russia in recent years has shown that cargo has decreased by 1.7 times. The reduction in cargo flows to Russia was caused by sanctions, as large Kazakh metallurgical and chemical enterprises listed on various stock exchanges bypassed Russia’s corridors. All of this should be considered a positive trend in redirecting Kazakh cargo through the Middle Corridor.

•An analysis of cargo flows, by rail transport between China and three neighboring countries (Kazakhstan, Russia, Mongolia) showed us that the volume of cargo imported into China is 5 times greater than the volume of cargo delivered from China to these countries in the reverse direction. This once again confirms that China is not a major hub for land-rail cargo flows.